Balance Transfer • For Salaried

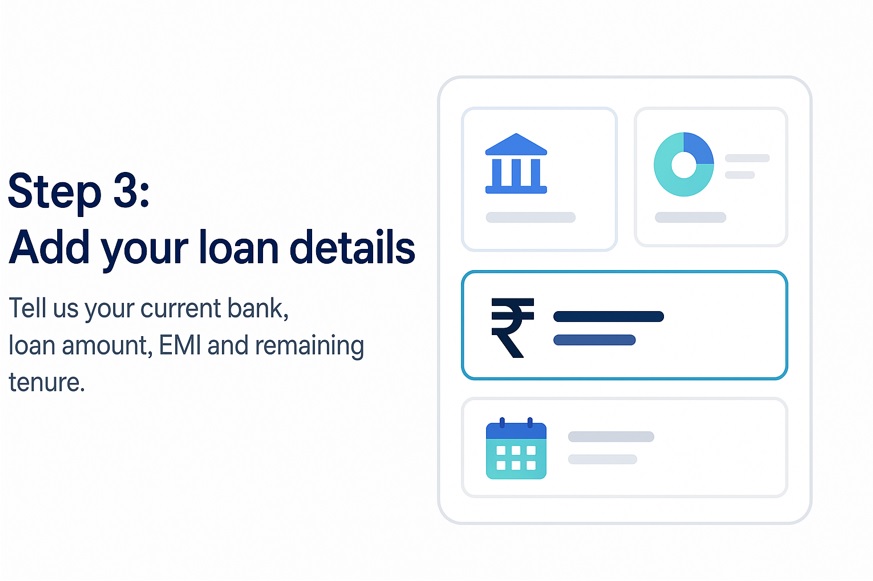

Switch to a lower rate & shrink your EMI

We compare partner-bank offers, guide foreclosure, and move your loan — end-to-end, fast and secure.

Reduse Rate To

9.99% p.a.

Get Your Offer

Online 10 seconds

Digital Journey

End-to-End*